- Blog Article

Operational Reporting vs. Analytical Reporting: Understanding the Differences

In today’s fast-paced business environment, making data-driven decisions is crucial for success. Organizations rely heavily on reports to guide their strategies, optimize processes, and measure success. Among the various types of reports used, two stand out as particularly critical: operational reporting and analytical reporting. While both play vital roles, they serve different purposes and audiences. Understanding the distinctions between them and how tools like GL Connect can enhance your reporting capabilities is essential for any enterprise.

What is Operational Reporting?

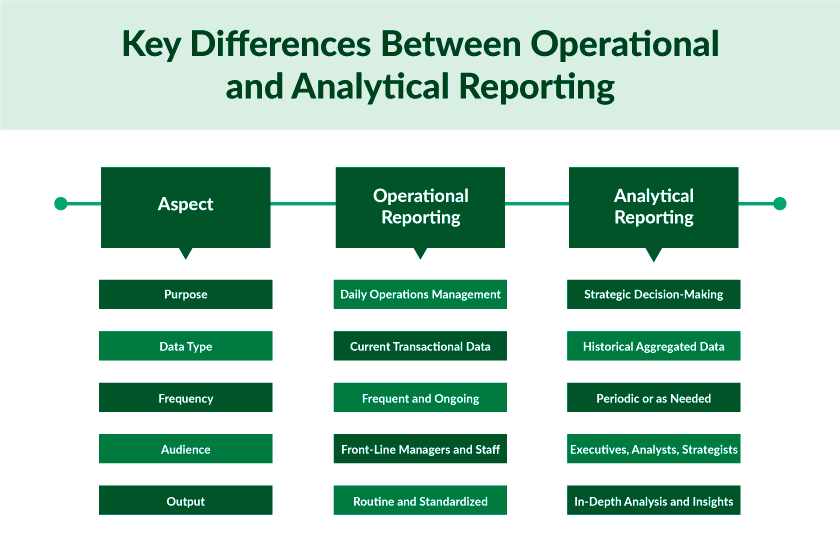

Operational reporting focuses on the day-to-day activities and transactions within an organization. These reports are used to monitor, control, and optimize ongoing business activities. The main goal is to ensure that business processes are running smoothly and efficiently. Key characteristics of operational reports include:

- Real-Time or Near Real-Time Data: Operational reports are often generated in real-time or near real-time to provide a current snapshot of business operations. This immediacy allows businesses to respond quickly to any issues or changes.

Routine and Repetitive: These reports are usually produced on a regular schedule, such as daily, weekly, or monthly, and they often follow a standard format. - Transactional: They track daily transactions and operational metrics.

- Short-Term Focus: The scope of operational reports is typically short-term, concentrating on immediate issues that require quick action or adjustment.

- Audience: Primarily used by operations managers and front-line staff to ensure smooth business processes.

Examples of operational reports include sales performance reports, inventory levels, customer service reports and financial status updates. The goal is to provide immediate insights that can help with quick decision-making.

What is Analytical Reporting?

Analytical reporting, on the other hand, is more strategic and focuses on trends, patterns and insights over time. It involves deeper analysis and interpretation of data to inform long-term business decisions. Key characteristics of analytical reporting include:

- Historical Data Analysis: Analytical reports typically analyze historical data over a longer period, allowing for the identification of trends and patterns that can influence future strategies.

- Complex and In-Depth: These reports often involve complex data analysis techniques, including statistical methods, predictive modeling, and data mining. The goal is to uncover deeper insights that are not immediately apparent in day-to-day operations.

- Strategic Focus: They are used for strategic planning, forecasting, and performance analysis. They help businesses understand the underlying causes of performance trends and predict future outcomes.

- Long-Term Scope: These reports help guide decisions that affect the organization’s future direction.

- Customization and Flexibility: Unlike operational reports, which are often standardized, analytical reports are usually customized to address specific business questions or challenges.

- Audience: Executives, financial analysts, and strategic planners use these reports for decision-making.

Examples of analytical reports include market trend analyses, customer segmentation reports, financial forecasts, and financial performance reports. The objective is to provide insights that can guide strategic decisions and drive business growth.

Operational Vs Analytical Reporting

Understanding the key differences between these two types of reporting is crucial for leveraging them effectively:

When to Use Operational Reporting vs. Analytical Reporting

Operational reporting is essential when you need to:

- Monitor key performance indicators (KPIs) in real-time.

- Ensure that business processes are functioning efficiently.

- Identify and resolve issues as they arise.

- Maintain control over day-to-day operations.

Analytical reporting is the right choice when you need to:

- Understand the reasons behind performance trends.

- Identify opportunities for improvement or growth.

- Develop long-term strategies based on data-driven insights.

- Make informed predictions about future outcomes.

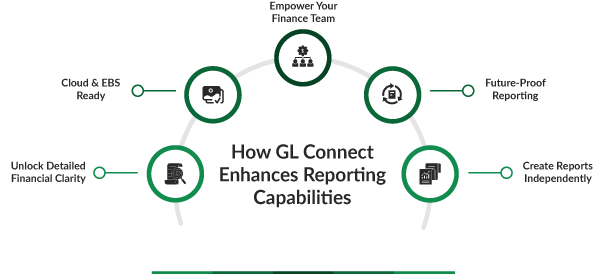

How GL Connect Enhances Reporting Capabilities

GL Connect is a powerful tool that bridges the gap between operational and analytical reporting, empowering businesses to unlock detailed financial clarity and create reports independently. Here’s how GL Connect enhances both types of reporting:

- Empower Your Finance Team – GL Connect empowers finance teams to generate both operational and analytical reports without relying on IT. Its user-friendly interface and robust capabilities ensure that your finance team can focus on what matters most: making informed decisions.

- Cloud & EBS Ready – With the ability to leverage Cloud and EBS data, GL Connect provides seamless integration with existing systems. This ensures that your operational reports are accurate and up-to-date, while analytical reports are comprehensive and insightful.

- Future-Proof Reporting – GL Connect’s future-proof capabilities mean that your business will always have access to the financial data it needs. Whether it’s adapting to changes in your chart of account structures or increased transaction counts, GL Connect ensures that your reporting strategy grows with your business.

- Unlock Detailed Financial Clarity – For CFOs and financial analysts, GL Connect offers in-depth drill-down capabilities that allow for a detailed examination of financial data. This ensures that both operational and analytical reports provide the financial clarity needed to drive strategic initiatives.

- Create Reports Independently – With GL Connect, financial users can create reports independently, reducing reliance on IT and accelerating the reporting process. This capability is crucial for both operational and analytical reporting, as it allows for rapid response to changing business needs.

Conclusion

Both operational and analytical reporting play crucial roles in the success of a business. While operational reporting provides the real-time insights needed for day-to-day management, analytical reporting offers the strategic insights necessary for long-term planning. By leveraging a tool like GL Connect, businesses can enhance their reporting capabilities, empowering teams to make better, data-driven decisions.

Incorporating GL Connect into your reporting strategy not only optimizes current operations but also ensures your business is well-positioned for future growth. Explore the full potential of GL Connect today and see how it can transform your reporting processes.

Bridget Roy

Finance Solutions Manager

Bridget Roy serves as a Finance Solutions Manager at SplashBI, leveraging over 30 years of experience in accounting and finance. Navigating through roles as a Cost Accountant, Controller, and Finance Manager, Bridget has cultivated a reservoir of knowledge and experience.. At SplashBI, she specializes in GL connect, SplashBI, and Financial Analytics, driving training, demos, and implementations with precision and authority. Armed with 30 years of mastery in Excel for comprehensive costing, analysis, and reporting, Bridget is committed to delivering excellence, ensuring organizations achieve unparalleled efficiency, accuracy, and transparency in their financial operations.