- Blog Article

10 Reasons GL Connect is Fortune 500’s Preferred Financial Analytics Software

What is Financial Analytics Software and Why It Matters

Financial analytics software is a tool to enable businesses to track, analyze, interpret and act on financial data insights. By turning raw numbers into actionable insights, financial analytics software plays a critical role in helping modern finance teams forecast trends, optimize budgets, make better money related decisions, and ultimately, drive profitability.A robust financial analytics software is able to consolidate data from multiple sources, allowing finance teams to create reports in no time, drill down to transactional details, and foresee performance metrics.

At a time when as many as 90% of finance leaders prioritize data-backed business decisions, having the right financial analytics software is essential to make good financial decisions in any organization.

Why a robust financial analytics software matters

Simply put, it’s because accurate, fast, and comprehensive financial insights can make or break strategic growth. Financial analytics software could either drive your organizations towards financial success or be a game of endless missed opportunities.

Whether you want to reduce operational risks, manage cash flow, or improve compliance, financial analytics software equips companies with the tools and technologies they need to make better, smarter, and faster decisions.

Modern and savvy financial analytics software such as GL Connect address several pain points that finance teams face regularly, such as:

- Accuracy and efficiency in financial reporting

- Learning hurdles when financial analytics shifts from Excel, creating productivity loss

- Often, financial analytics software isn’t able to connect various data sources needed for financial reporting. Examples include Oracle EBS, Fusion Cloud, and external databases

- Data transformation can often be slow and manual, especially when managing hierarchies and reporting structures. This increases reliance on IT teams

- Report distribution is neither automated nor schedulable, which good financial analytics software addresses

- Legacy financial analytics software doesn’t have inbuilt financial reports and drillable trial balances, which creates manual workflows in reporting and makes the process more complex than it needs to be

Such inefficiencies cause higher dependency on IT teams even for simple reporting workflows, slowing down financial decision making.

But solid financial analytics software addresses all these inefficiencies and pain points. Let’s see how.

10 Reasons Why Fortune 500 Companies Prefer GL Connect as their Financial Analytics Software of Choice Over Competitors

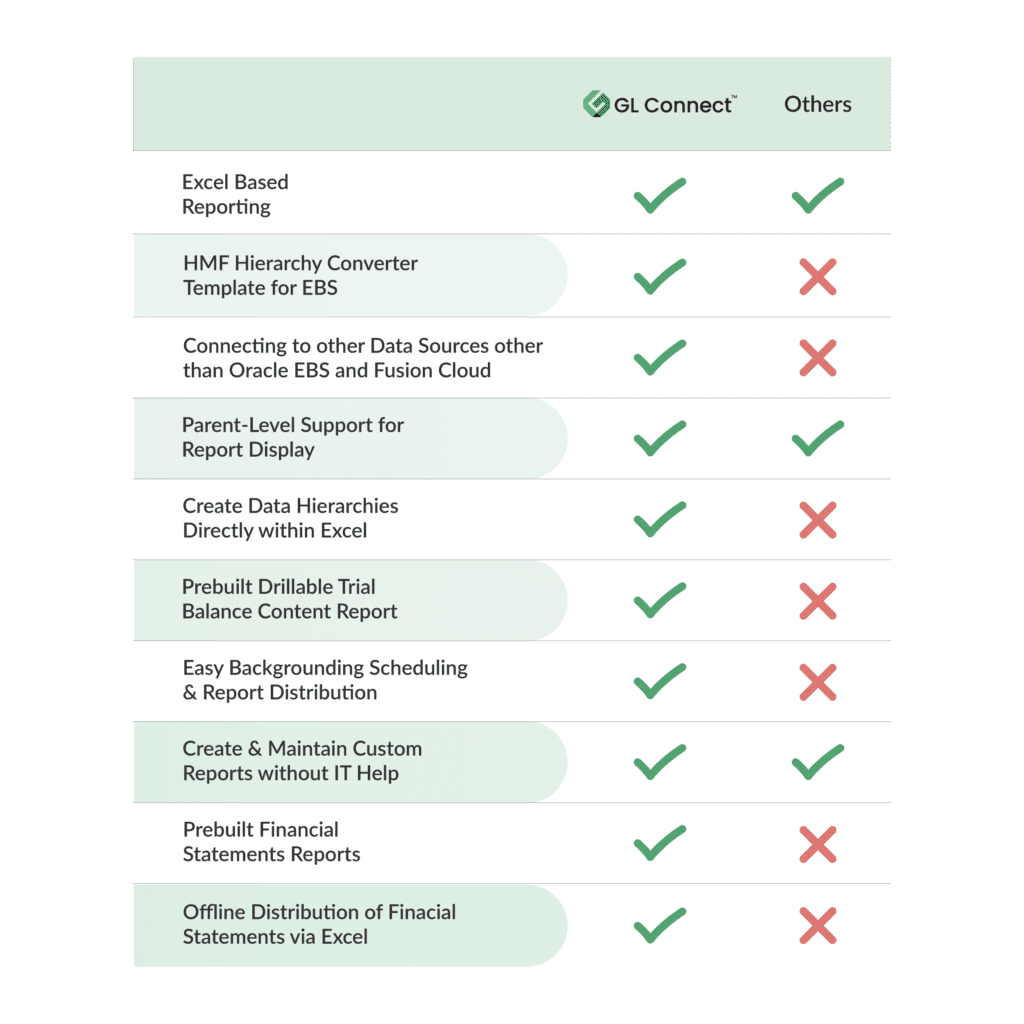

Financial reporting, especially financial analytics software, is a competitive landscape. And yet, several Fortune 500 companies trust GL Connect in this competitive landscape, to simplify, improve, and streamline reporting processes. So, what sets GL Connect apart from the competition? Let’s find out and break down the top 10 reasons why leading companies choose – and trust – GL Connect over others:1) Excel-Based Reporting

A staggering 80% of finance teams around the world continue to use MS Excel for their financial reporting needs. GL Connect, as the financial analytics software of choice, meets finance teams where they are – on a familiar interface they already trust and use daily. This eliminates the need for costly training and allows finance teams to hit the ground running in quick and efficient report generation.2) HMF Hierarchy Converter for EBS

Unlike competitors, GL Connect offers a highly useful HMF Hierarchy Converter that is tailored for Oracle E-Business Suite (EBS). This allows smooth data transformation and analysis, with finance teams not having to waste time on this data transformation. The HMF Hierarchy Converter feature alone improves data hierarchy management and enables much more accurate reporting.3) Access and Connectivity to Multiple Data Sources

Unlike its competitors, GL Connect doesn’t restrict its users to Oracle EBS and Fusion Cloud. GL Connect can connect to external data sources too. This gives finance teams much greater flexibility and control over data consolidation and analysis.4) Parent-Level Support for Report Display

While GL Connect, along with other financial analytics software tools, do offer parent-level report display, GL Connect goes a step further. It allows drill-down capabilities which offers deeper insights directly into Excel.5) Data Hierarchies Directly in Excel

Most financial analytics software tools require IT assistance to create and modify data hierarchies. But GL Connect enables creation of direct hierarchy within Excel. This enables finance teams to customize reports without depending on IT teams. This not only empowers business users but also frees up IT team’s time for more strategic interventions.6) Prebuilt Drillable Trial Balance Content Reports

Prebuilt drillable trial balance reports are available on GL Connect, unlike it competitors. This offers easy navigation from report summaries to details. Since competitors lack this feature, they leave finance teams to manually create detailed reports, increasing their workload on reporting workflows.7) Easy Scheduling and Report Distribution

GL Connect enables background scheduling and distribution of reports. This further simplifies reporting workflows, reduces manual intervention, and allows users to schedule reports whenever required. Ultimately, this feature boosts productivity and efficiency.8) Custom Report Creation Without IT Assistance

One of GL Connect’s core benefits is that it allows finance teams to create and maintain reports without relying on IT team’s assistance. Such autonomy ensures accelerated report generation and greater independence in managing and using financial insights.9) Prebuilt Financial Statement Reports

Prebuilt reports on GL Connect include ready-to-use financial statement templates. These templates end up saving the finance teams’ time and ensure reporting accuracy. On the other hand, competing financial analytics software tools require building templates from scratch. This adds unnecessary complexity to the reporting processes, which GL Connect simplifies.10) Offline Distribution of Financial Statements via Excel

GL Connect enables users to distribute financial statements offline too, on Excel. This ensures that all stakeholders receive critical reports on time, with or without system access. GL Connect competitors do not offer this functionality.Typically, Fortune 500 companies are known to choose efficient, accurate, and flexible tools that ensure both hard and smart work among their workforces. GL Connect checks all these boxes, enabling finance teams to operate at peak performance. That’s precisely the reason why Fortune 500 companies choose GL Connect over competitors.

Ready to Empower Your Finance Team with GL Connect Financial Analytics Software?

Having the right tools in your arsenal is essential to stay competitive in the modern industry. GL Connect excels as a financial analytics software of choice for companies of all sizes, especially Fortune 500. It’s all thanks to its unmatched flexibility and ease of use.From Excel-based reporting to pre-built templates, GL Connect scores way above its competitors in helping finance teams save time, reduce errors and drive profitability.

If you want to empower your finance team with these capabilities, book a demo to see for yourself why top companies trust GL Connect. It’s a financial analytics software of choice for one and all!